Unused Office Supplies Is What Type Of Account . In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Classifying office supplies is easy. Web what is the accounting treatment for used office supplies? The accounting for used office supplies may differ based on. Looking at the above transactions, the following would be. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. The classification of current office resources as either.

from www.pearson.com

In accounting, the company usually records the office supplies bought in as the asset as they are not being used. The classification of current office resources as either. The accounting for used office supplies may differ based on. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. Web what is the accounting treatment for used office supplies? Classifying office supplies is easy. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Looking at the above transactions, the following would be.

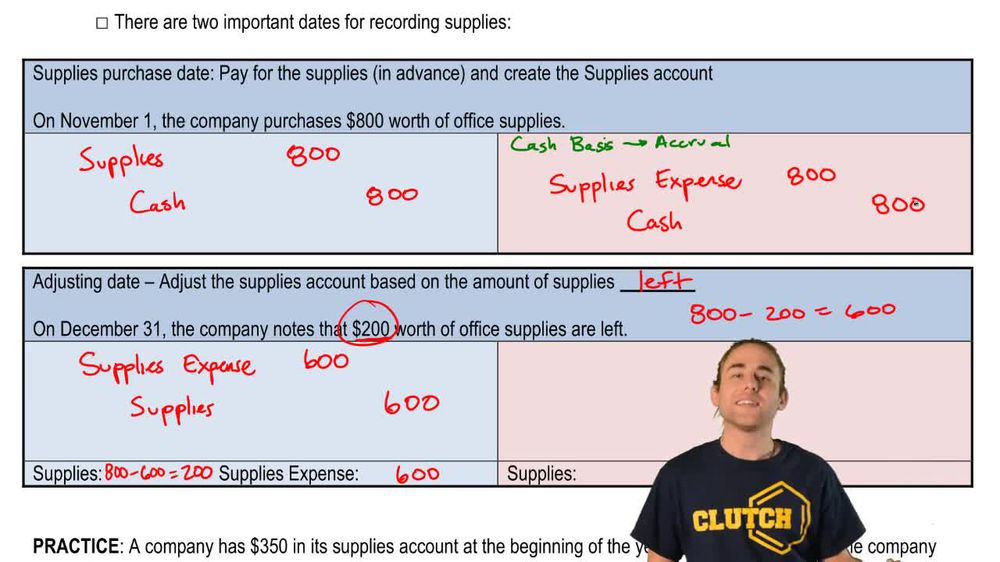

Adjusting Journal Entries Supplies (Cash Basis to Accrual Method

Unused Office Supplies Is What Type Of Account Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web what is the accounting treatment for used office supplies? Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Classifying office supplies is easy. The classification of current office resources as either. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. The accounting for used office supplies may differ based on. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Looking at the above transactions, the following would be.

From www.chegg.com

Solved The following unadjusted trial balance contains the Unused Office Supplies Is What Type Of Account Looking at the above transactions, the following would be. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web what is the accounting treatment for used office supplies? In accounting, the company usually records the office supplies bought in as the asset as they are not being used. The classification of current office. Unused Office Supplies Is What Type Of Account.

From wordschools.com

List Of Office Supplies Office Supplies Vocabulary Word schools Unused Office Supplies Is What Type Of Account Classifying office supplies is easy. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web what is the accounting treatment for used office supplies? The classification of current office resources as either. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a.. Unused Office Supplies Is What Type Of Account.

From www.bartleby.com

Answered Balance Sheet as on 31 July, 2015… bartleby Unused Office Supplies Is What Type Of Account Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Looking at the above transactions, the following would be. Web the adjusting entry is to debit supplies expense for. Unused Office Supplies Is What Type Of Account.

From template.wps.com

EXCEL of Detailed Inventory of Office Supplies.xls WPS Free Templates Unused Office Supplies Is What Type Of Account The accounting for used office supplies may differ based on. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Web what is the accounting treatment for used office. Unused Office Supplies Is What Type Of Account.

From templates.udlvirtual.edu.pe

Printable Free Office Supply Inventory List Template Printable Templates Unused Office Supplies Is What Type Of Account Looking at the above transactions, the following would be. The accounting for used office supplies may differ based on. The classification of current office resources as either. Classifying office supplies is easy. Web what is the accounting treatment for used office supplies? In accounting, the company usually records the office supplies bought in as the asset as they are not. Unused Office Supplies Is What Type Of Account.

From civiconcepts.com

Office Equipment List And Their Uses Unused Office Supplies Is What Type Of Account Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Looking at the above transactions, the following would be. The accounting for used office supplies may differ based on. Classifying office supplies is easy. The classification of current office resources as either. Web when you use the accrual basis. Unused Office Supplies Is What Type Of Account.

From www.chegg.com

Solved 20) 20) Prior to recording adjusting entries, the Unused Office Supplies Is What Type Of Account Classifying office supplies is easy. The classification of current office resources as either. Looking at the above transactions, the following would be. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be. Unused Office Supplies Is What Type Of Account.

From officesuppliestobikogu.blogspot.com

Office Supplies Image Office Supplies Unused Office Supplies Is What Type Of Account Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. The classification of current office resources as either. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. The accounting for used office supplies may differ based on. Web what is the accounting treatment. Unused Office Supplies Is What Type Of Account.

From ladydecluttered.com

30 Office Supply Organization Ideas » Lady Decluttered Unused Office Supplies Is What Type Of Account Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Classifying office supplies is easy. Web what is the accounting treatment for used office supplies? The classification of current office resources as either. Web when you use the accrual basis of accounting, you record unused office supplies in an. Unused Office Supplies Is What Type Of Account.

From promova.com

Office Supply List Unused Office Supplies Is What Type Of Account Web what is the accounting treatment for used office supplies? Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. Classifying office supplies is easy. The accounting for used office supplies may differ based on. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for. Unused Office Supplies Is What Type Of Account.

From www.coursehero.com

[Solved] Learning Activity 1. Prepare the necessary adjusting entries Unused Office Supplies Is What Type Of Account Web what is the accounting treatment for used office supplies? In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Classifying office supplies is easy. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. Web the adjusting entry is. Unused Office Supplies Is What Type Of Account.

From www.gettyimages.com

Eliminate Unused Office Supplies Photos and Premium High Res Pictures Unused Office Supplies Is What Type Of Account Classifying office supplies is easy. The accounting for used office supplies may differ based on. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web when you use. Unused Office Supplies Is What Type Of Account.

From www.double-entry-bookkeeping.com

Purchase Office Supplies on Account Double Entry Bookkeeping Unused Office Supplies Is What Type Of Account The classification of current office resources as either. The accounting for used office supplies may differ based on. Web what is the accounting treatment for used office supplies? In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web when you use the accrual basis of accounting, you record unused. Unused Office Supplies Is What Type Of Account.

From www.chegg.com

Solved On March 1, Cyber Corporation had office supplies on Unused Office Supplies Is What Type Of Account Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. The classification of current office resources as either. Web what is the accounting treatment for used office supplies? The accounting for used office. Unused Office Supplies Is What Type Of Account.

From financialfalconet.com

Supplies expense is what type of account? Financial Unused Office Supplies Is What Type Of Account Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web what is the accounting treatment for used office supplies? The classification of current office resources as either. Web in. Unused Office Supplies Is What Type Of Account.

From www.patriotsoftware.com

Types of Accounts in Accounting Assets, Expenses, Liabilities, & More Unused Office Supplies Is What Type Of Account Looking at the above transactions, the following would be. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web in the case of office supplies, if the supplies purchased. Unused Office Supplies Is What Type Of Account.

From www.chegg.com

Solved For each transaction, (1) analyze the transaction Unused Office Supplies Is What Type Of Account Classifying office supplies is easy. Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web what is the accounting treatment for used office supplies? Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. In accounting, the company usually records the office supplies. Unused Office Supplies Is What Type Of Account.

From utrading.com.my

10 Essential Office Supplies You Should Have And How To Store Them Unused Office Supplies Is What Type Of Account Web the adjusting entry is to debit supplies expense for $1,000 and credit supplies for $1,000. Web when you use the accrual basis of accounting, you record unused office supplies in an asset account and charge. Web in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a. The classification of. Unused Office Supplies Is What Type Of Account.